Protecting your assets while making sure you get the medical care you need and want should be within reach for all of us. It’s confusing and stressful to figure out the current healthcare system. Fortunately, we’ve found a solution that works for us and can work for you too. We’ve undergone extensive training to become a Certified Sedera Affiliate, met the company leaders, and have asked their representatives tons of questions.

Enrollment is super easy and takes about 10 minutes. Sign up now!

As long-time FIRE advocates (Financial Independence Retire Early), here’s what we like about Sedera:

-

Cheaper than traditional health insurance (75% cheaper in some cases)

-

No religious commitment

-

No network: Use any provider you like, anywhere

-

Timely payment of eligible expenses

-

A+ Rating from the Better Business Bureau

-

Easy sign up

-

Clear, easy-to-understand sharing guidelines

-

No open enrollment or difficult-to-understand packages

-

Preventive care (mammograms, colonoscopies, and flu shots)

-

Expert second opinions

-

Web-based interface for tracking bills, needs, and payments

-

Responsive, US-based customer support (in Austin, TX)

-

Transparency and low profit margins – your dollars go to helping members in need

-

Membership growth has been organic to ensure that members are a good fit

-

Discounted rates from providers (over two decades of experience negotiating medical bills)

-

Supports healthy lifestyles by rewarding good behavior (non-smokers pay less, DPC members get a discount)

-

Choices from $500 to $5K IUA allowing peace of mind for every budget

-

Great option for the self-employed and FI seekers. Protect your assets!

-

Only one raise in rates in 4 years

-

Telemedicine (through publicly traded Teladoc, the first and largest telemedicine company in the US)

-

Rx help

-

International care is included

Bill’s Story: Why I Joined Sedera, or how I got better service for less money

My family joined Sedera because we needed some sort of coverage but the ACA was just too expensive. I’m in my early 50s, retired, and we were paying over $2K/month with a high deductible. At first I was attracted to Liberty (the least religious of all the Christian Health Sharing Ministries) but had moral difficulties with their exclusion of non-religious people (and their stance on certain women’s health issues). Why should religion have anything to do with health?

So, I searched and found Sedera. Secular, more agile, with an A+ BBB rating and on top of it all, cheaper! We now have excellent care through two local DPCs and complete assurance about catastrophes through Sedera.

Why Sedera is great for the FIRE community (Financial Independence Retire Early) or brass tacks; what does it really cost?

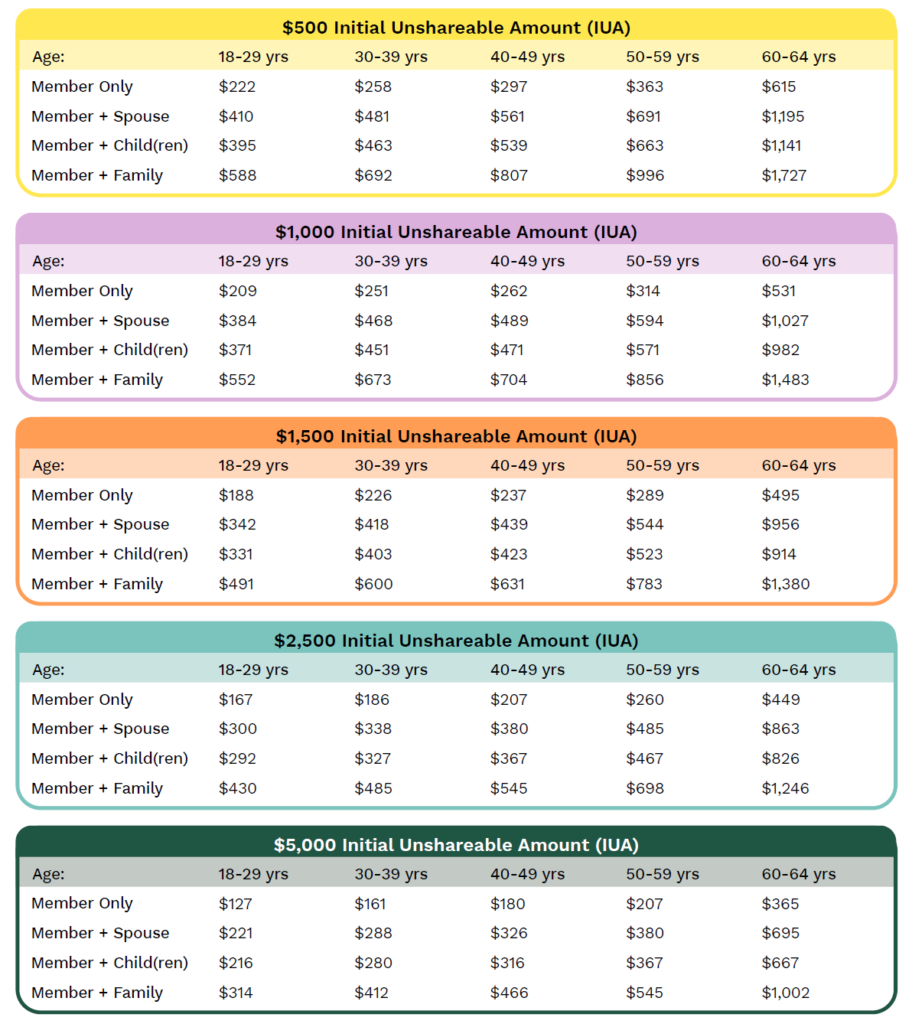

Self employed? Just quit your job and can’t deal with the hassle and expense of COBRA? Early retiree? Sedera works for you because you can sign up any time – there is no open enrollment period. Also, guess what? The prices are low. Like so low you’ll start to wonder why standard insurance is so expensive (and that kind of wonder is probably why you’re here in the first place). A quick example: 34 year old, single, member of a DPC, with a $2500 IUA: $157 per month!

Below are prices for members of a DPC (MO is Member Only, MS is Member +Spouse, MC is Member+Children MF is Member+Family):

Click Below For Downloadable PDFs

“ I can’t believe how easy this was. Sign up was quick, and my first medical bill was reimbursed in two weeks! ”

Amy M., Member

FAQs

How do care and payments work (compared to insurance)?

You’re probably already familiar with how health insurance works, and Sedera has some similarities though it’s not insurance. Think of Sedera as a group of your healthy friends who want to pool their resources to share health-related needs. In fact, with Sedera, when you have a medical bill you submit it (online – you have your own private portal) as a “Need”. Once approved, Sedera sends you your “Share.” Depending on your level of membership, you have an IUA (Initial Unshareable Amount) and just as you guessed, this is the dollar amount that you’re responsible for before you can submit a Need to be Shared.

How do I know Sedera won’t take my money and run?

This is one of the most common questions so we’ve put it here first. The answer is: You don’t. Sedera is not insurance and is not regulated. They have super scary, upfront ALL CAPS disclaimers on their site to make sure you understand the risks (and they want all members to actively CHOOSE to join). In order to keep their prices low (which was initially my main reason for joining), they have limitations and some of those would run up against the rules surrounding insurance. As such, they **have** to clearly post that they are NOT INSURANCE, etc.

If that scares you off as soon as you read it, then you can skip the rest and move on. However, if you’re a discerning consumer (of course you are, you’re on this site!), you will read on and see that there’s a lot to calm your concerns: They’ve been in business for over seven years (and their executive team has decades of health care experience), with no lawsuits, no complaints and they were even nominated for the coveted BBB Torch award for ethics. They have 30K+ members (and growing) and if they were in the business of taking your money and not providing services, our tried-and-true free market system would crush them like a bug. They’re totally transparent with their pricing and their guidelines. Plus, all operations are 100% US-based in Austin, TX and you can call them and they’ll answer. Think about how all of those points compare to your current health insurance provider!

How long does it take to sign up, and what will I need?

If you’re a smart person (of course you are) who knows how to navigate the web and has filled out an online form before (ditto), then I’d suggest setting aside 15 minutes to go through the educational materials and then sign up at this link. You’ll need your SSN, bank account info, a credit card and some basic knowledge about your family. It’s really easy (particularly if you compare it to signing up for health insurance). However, it’s not currently available in Illinois, New York, Washington, Vermont, and (as of February 1, 2022) Pennsylvania. But they’re working on it!

When does membership start?

Membership starts immediately, just like signing up with a DPC (or car insurance, Spotify, etc.).

Are there limitations on when I can sign up? Can I jump in the day after I quit my job, regardless of when that is? (Congratulations, btw!)

There’s no “open enrollment” or any other limitations – it’s very straightforward (as it should be). Skip COBRA and join up, or finally get some peace of mind as a gig worker or self-employed person. You can pay with a credit card or your bank account and you will be billed monthly on the date you signed up.

How do I pay? Can I use a credit card?

Yes! You can pay with a credit card or your bank account and you will be billed monthly on the date you signed up. It’s all automated and very much like other memberships you’re familiar with (and unlike the reams of legalese and paperwork you’ve maybe dealt with in the past).

What’s included without meeting my Initial Unshareable Amount?

Well-patient mammograms, colonoscopies, flu shots, vaccinations for kids and other wellness events are included 100% – no need to reach your IUA first. You can read about what’s specifically allowed (and not) in Sedera’s Membership Guidelines. Bill’s 52-year-old wife recently had a routine mammogram. She made the appointment, stated she was an uninsured, cash-pay customer and secured a fantastic price which she paid for with her credit card. We submitted the two bills (imaging and the “reading” of the images) to Sedera via our private portal (snapped pics with the mobile phone) and received payment (check or direct deposit, your choice) 18 days later.

What if I need a million dollar total head transplant? Are there any caps to how much will be shared?

In short, you pay your IUA and Sedera Members share the rest (aka you receive payment). There is NO UPPER LIMIT on a Need. Period. How can this be? Sedera has an entire group that helps negotiate pricing on major health events, and as such, that huge price is usually significantly reduced. Remember, hospitals and other health service providers are just running a business and given the chance to negotiate for faster payment often means they’ll offer a better rate.

So I have a $1500 IUA; does that mean I have to pay that much of each bill I submit?

No way! Your $1500 IUA is per Need. So if you have a heart attack, that counts as a single need. You may continue to get treatment for that issue for a year (or more); all bills associated with that Need are included under your single IUA. You pay $1500 and the rest is shared.

What about pre-existing conditions (PEC)?

You CAN sign up for Sedera if you have a PEC.

Sedera limits sharing for any PEC treated in the 3 years before signing up. You can totally sign up and have everything else shared, just not that condition during your first year of Membership. However, during the second year, you are eligible for $15k of Sharing, the third year $30k, and once you start your fourth year of membership, it would be fully shareable.

What else is excluded?

A quick answer is: Anything illegal. If you are injured doing an illegal activity or from the use of illegal drugs, you’re on your own. I like this feature: It makes fellow members accountable for their own actions. There are detailed specifics in the guidelines, which are thorough but written in everyday language and are required reading before you sign up. Sedera doesn’t want just anyone – members are committed to taking responsibility for their own health and by extension, the other members of the community.

What’s my maximum annual expense?

You’re responsible for your IUA for each Need, but only for a maximum of three Needs per year (whether individual or family). For example, if you have a $500 IUA you pay the first $500 for your broken leg on January 1st, the first $500 for your kidney stones in March and the first $500 for your broken arm in April. After that (what a bad year!), you are no longer responsible for any more IUAs on subsequent needs (if you continue to have bad luck). Your total out-of-pocket expense for your three bouts of bad karma payback will cost a total of $1500, regardless of how long your recovery is or how much it costs. Of course, you’re also responsible for your Monthly Contribution throughout your Membership period.

What about maternity and pregnancy costs?

This is a big question and deserves a big answer but here’s the quick and general response: Sedera considers births, maternity and prenatal care shareable, but does not share in voluntary terminations. All pregnancies are subject to a $5K IUA ($7500 for non-emergency C-sections). This is to discourage people who join just to have their maternity costs shared, then leave the community.

What’s their stance on prescriptions?

Sedera separates medications into two groups: curative and maintenance. Loosely explained, they share the former until you’re better. If a medication is initially prescribed to cure an ailment, it’s included, but if it becomes a maintenance drug, then only 120 days of that prescription will be shared. Some simple examples of curative drugs are antibiotics, pain meds and even chemotherapy. Statins, insulin and birth control (unless prescribed for a curative issue) would be considered maintenance drugs. Also, as an active member, you have access to Sedera’s RX Marketplace, where you’ll find incredible resources for inexpensive prescriptions, diabetic supplies and more.